Your funding source for all your

capital needs.

HELP US TO BETTER UNDERSTAND YOUR FUNDING GOALS.

Let us work together – Explain your funding goals – Speak with a Specialist

HERE IS OUR PROCESS

Fill out the form : ” Request for Capital ”

Use the comment box to explain in details your funding needs.

- Once we receive the form, a specialist that is versed in your needs will call you back asap.

- Now you are speaking with professional that can answer all your questions and works with you to achieve your funding goals.

We want to understand you – So that we can better serve you!

HERE ARE OUR LOAN PROGRAMS

We are your funding source for all your capital needs - We work with over 70 Lenders!

We build relationships, not just fund you!

WANT TO SPEAK WITH A FUNDING SPECIALIST?

Just simply fill out the request form - Tell us a little about your needs

GET A CALL BACK WITHIN MINUTES FROM A SPECIALIST!

Business Funding Programs

When it comes to Business Funding, we offer all funding programs for businesses. We listen and try to get you the best funding program that fits your needs.

BUSINESS LOAN PROGRAMS

- Same Day Business Loans

- Personal Loans up to$200K with a 680+ FICO

- Business Lines of Credit

- Business Term Loans

- All Equipment Financing – Truck and more!

- Get up to $150,000 with 0% Apr – 680+ FICO

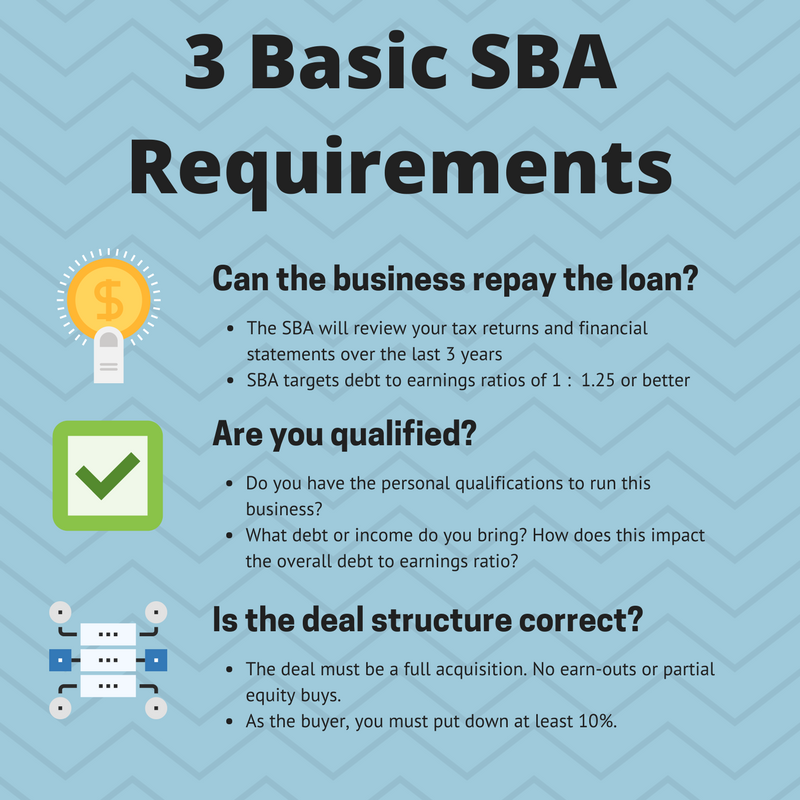

- All SBA Loans

- Start Up Business Loans

- Much more!

Hard Money for Real Estate

We offer Nationwide Hard Money for Residential and Commercial Properties. We work with several lenders to get you the best finacing. Lets us build a relationship.

HARD MONEY FOR REAL ESTATE

- Fix and Flip

- Purchases

- Cash Out Refinance

- Ground Up Construction

- Bridge Loans

- Commercial Properties

- Multi Family

- Buy and Rent

- Much more!

Mortgages Programs

We offer Nationwide Residential Mortgages. We work with lenders that can do even the difficult deals. Let us work with you to get your dream home financed.

MORTGAGE PROGRAMS

- First Time Home Buyer

- FHA Loans

- VA Home Loans

- Reverse Mortgages

- Refinance

- BanK Statement Home Loans for the self employed

- Alternate Owner Occupied Equity Loan with NO Monthly Payments

Nationwide SBA Loans! - All SBA Loans

FILL OUT THE FORM THAT BEST FITS YOUR NEEDS

GET A CALL BACK FROM A SPECIALIST ASAP!

The Employee Retention Credit

Get up to $26,000 per W2 Employee - Its a Tax Grant NOT a loan

$26,000 per Employee as a Tax Credit!

COVID-19 has been a challenge for all of us. As the world shut down the economy came to a halt, leaving the future of many businesses in a precarious position. As we begin to find normalcy again, businesses now have to focus on recovering and fortunately, several government programs are easing this process.

One such program is the Employee Retention Credit or ERC, which is a generous stimulus program designed to bolster those businesses that were able to retain their employees during this challenging time. Due to the extremely complex tax code and qualifications, it is severely under-utilised. Details of the program include:

- UP TO $26,000 PER EMPLOYEE

- AVAILABLE FOR 2020 & Q1 – Q3 2021

- QUALIFY WITH DECREASED REVENUE

- OR QUALIFY WITH COVID EVENT

- NO LIMIT ON FUNDING (ERC IS NOT A LOAN)

- ERC IS A REFUNDABLE TAX CREDIT

What is the CARES Act Employee Retention Credit Stimulus?

The Employee Retention Tax Credit (“ERC”) is an economic recovery program created by the CARES Act – the same legislation that created the Paycheck Protection Program (PPP). In addition to PPP, your business may qualify for a stimulus check of up to $26,000 per employee by claiming employee retention tax credits.

Bank Statements - Self Employed Home Loans

NO TAX RETURNS - NO W9 - NO PROOF OF INCOME

We use your total annual deposits and NOT your profits to

determine your Qualifications!

EQUITY LOAN ALTERNATIVE - 500+ CREDIT SCORE ACCEPTED

Get access to your Equity with No Monthly Payments

Great for Owner Occupied - 2nd Home - Non Owner Occupied - One to Four Units

Get up to $500k from your home equity – No Monthly Payment!

- No monthly payments.

- No income requirements.

- No need for perfect credit ( 500+ FICO Accepted )

PROPERTIES THAT ARE ACCEPTED:

- Owner Occupied

- 2nd Home

- Non Owner Occupied

- One unit to Four Units

Home Equity Investment

Achieve your financial goals, whether you’re looking to tap your home equity.

Program is available to homeowners in select areas of California, Washington, Oregon, Colorado, New Jersey, Massachusetts, Virginia, Washington DC, Florida, New York, Maryland, Pennsylvania, Illinois, Michigan, Minnesota, Ohio, Arizona, North Carolina, and Connecticut, but we are moving quickly to bring Point to more homeowners.

Nationwide Hard Money Loans

Residential and Commercial – Real Estate Financing!

- Fix and Flip

- Purchases

- Cash Out Refinance

- Ground Up Construction

- Bridge Loans

- Commercial

- 30 Years Buy and Rent

- SBA Commercial Loans

- and More!

You need an experienced partner on your side - We build relationships!

Business Owners – Increase Your Sales!

Offer your Clients in House Financing

You get your funds for cost of Service or Products within 72 hours

Clients pay us – Not Fully based on Client’s Credit

BUSINESS CREDIT FUNDING

Get up to $150,000 with 0% Apr for up to 18 Months.

Great way to Raise Capital to Start a Business or Invest In Real Estate etc.

NO TAX RETURNS – NO PROOF OF REVENUES – NO DOCUMENTATION

- No Documentation

- No Tax Returns

- No Proof of Business Revenues

- You DO NOT have to be in business to be a business

BUSINESS CREDIT AND ITS ADVANTAGES

Business credit can be used as a tool to raise capital. You do not have to be in business to be a business. For those that do not have a LLC or Corp, we do sell aged LLC or Corp to help you get the capital.

Here is what you can achieve with establishing and building business credit.

Get up to $150K with 0% Apr with No Tax Returns and No proof of Business Sales / Revenues.

- Business Lines of Credit – with NO Documentation and NO Business Revenues

- Cars in your Company’s Name using your EIN and not your SSN ( Great for Turo Business )

- When done right you will keep getting funded as time goes by.

- You can get another LLC, Build Business Credit and FUND again.

- Your Personal Credit remains STRONG!

- You can establish and build business credit to as many Corps or LLC as you please!

HOW DOES THIS WORK?

You can raise capital by setting up an LLC or Corp to be fundable. This means we make sure that your LLC or Corp is set up correctly which is a checklist of task that is called the 20 Points Compliance Check and then we establish and build business credit on that LLC or Corp, creating a Business Credit Score similar to your personal credit score.

There are TWO phases to getting a LLC or Corp ready for funding.

- The 20 Points Compliance

- Establishing and Building Business Credit ( Applying and getting Net 30 Accounts to post to your business credit profile )

WHAT FUNDING CAN I ACHIEVE ONCE THE LLC OR CORP HAS COMPLETED THE TWO PHASES ABOVE?

- No Personal Guarantee Funding up to $150,000 based only on the Business Credit, meaning the EIN Number and not your SSN

- Personal Guarantee Funding up to $250,000 with a Build out Business on a LLC or Corp and a Personal Credit Score of 680+ with the qualifications listed below.

PERSONAL CREDIT QUALIFICATIONS

- 680+ Credit Score ( 720+ Preferred )

- Must have at least THREE revolving accounts on your credit profile that is 2+ years old in good standing. Revolving accounts are credit cards.

- DTC less than 28% – Your total credit card usage is under 28% of the available credit. Preferred is less than 15%.

- No Negatives

- No Lates

- Less than TWO inquiries in the last SIX months.

- Great to have a high limit credit card that is $20K+ and 5+ years old ( We recommend a Authorize User Tradeline for thoose that do not have a account as such on your file ). NEED ONE? – SEE LIST

- Those with Mortgages and Auto loans on thei credit will get better approvals.

BUSINESS CREDIT QUALIFICATIONS

- Corp or LLC that is 2+ years old. New corps or LLC will also be able to get funded but banks likes companies that are 2+ years old.

- The 20 Points Compliance Check on your LLC or Corp is completed. SEE LIST

- Business Credit Score is 80 Paydex. You can still get funded without a paydex score but for larger funding, we suggest for you to build business credit. See vendors that you can apply to to get small credit lines to report to your business credit so that you can get a 80+ Paydex Score. You must however complete the 20 Points compliance before you start applying to Net 30 Accounts to establish a business credit profile and score. SEE Net 30 Accounts.

Business Lines of Credit up to $250,000

- True Line of Credit

- Terms: 12 months to 60 months

- Bank Rates starts at 8.99%

- Credit Score 680+

- Time in Business: 1+ Years

- Annual Revenues: Minimum $250,000

Personal Credit Profile

- 680+ FICO Score Required with at least THREE revolving accounts that are 2+ years old and in good standing.

- DTC under 28%

- Less than TWO inquiries in the last SIX months.

- No Negatives

- No Lates

- Credit Partner Accepted

- NO UPFRONT FEES

- Corp or LLC ( 2+ years old, 3+ years old preferred.

- Business Credit a Plus

- Business Creditbility Check a plus

- Fill out application

- Meet qualifications – we request supporting docs.

- We can get a loan approval within minutes or 72 hours

- Funding in instant in some cases to 72 hours

Personal Funding up to $300,000 with a 680+ FICO Score

Personal Funding up to $300,000 Program Details:

Get term loans with interest rates

Personal Credit Profile

- 680+ FICO Score Required with at least THREE revolving accounts that are 2+ years old and in good standing.

- DTC under 28%

- Less than TWO inquiries in the last SIX months.

- No Negatives

- No Lates

- Must be able to prove $40,000+ in income per W9 and Tax returns – Personal.

- We charge 15% success fee on all funding received.

- True Term Loan

- Transunion Credit Score: 730+

- The more income you can prove through W9 or Business Tax Returns, the more you will be approved for. Good Income will be $50K+

- Can be done through Personal or Business

- Must have at least THREE accounts on your Transunion credit that is 2+ years old in good standing.

Credit Partner is someone with great credit that is willing to help you get funded.

Fast Funding up to $150,000 with 0% Apr

For those that needs fast funding, once you have met the qualifications, we can start your funding immediately.

Program Details:

Get funded up to $150,000 with most of the Business Credit Card having an introductory 0% Apr for up to 18 months depending on the card issuer.

Personal Credit Profile

- 680+ FICO Score Required with at least THREE revolving accounts that are 2+ years old and in good standing.

- DTC under 28%

- Less than TWO inquiries in the last SIX months.

- No Negatives

- No Lates

- We charge a 13% Success fee on all funding received.

Credit Partner is someone with great credit that is willing to help you get funded.

Business Credit Profile

- Corp or LLC that is 2+ years old.

- New Corps or LLC also accepted

- 20 Points Compliance Checklist Preferred

- Established Business Credit wth an 80 Paydex Preferred.

Transunion Only Funding up to $150,000 – 730+ Transunion Score

- Must have a 730+ Transunion Personal Credit Score with 4+ years of History!

- Transunion Credit Score of 730+ with 4+ Years of History ( MUST BE STRONG )

- Must be able to prove income of $50,000+ per year ( Pay Stubs / Tax Returns – Personal or Business )

- Need one recent pay stub before funding also.

- PROGRAM DETAILS

- TRUE Term Loan

- Terms: 4 to 10 years

- Rates: Start as low as 9% to 11%

- Funding Time: 7 to 10 days

- No Credit Hard Pull

- No Upfront Fees

- No Business Credit Needed

- Does NOT report to Personal Credit

- We charge a 15% Success Fee on this Loan Product, that you can pay from the funding.

Speed depends on you getting us the paperwork that we need to submit to the Bank

We have been seeing an average of $100K to $120K in funding – Some as high as $180,000

CREDIT REVIEW

Please send us a complete copy of your credit report in PDF format

You can also send us the login to Identity IQ as Follows: Username, Password, Last 4 of SSN

Business Funding $50,000 to $250,000 with 0% Apr

Personal Credit Profile

- 680+ FICO Score Required with at least THREE revolving accounts that are 2+ years old and in good standing.

- DTC under 28%

- Less than TWO inquiries in the last SIX months.

- No Negatives

- No Lates

- Credit Partner Accepted

Credit Partner is someone with great credit that is willing to help you get funded.

Business Credit Profile

- Corp or LLC that is 2+ years old.

- New Corps or LLC accepted

- 20 Points Compliance Checklist Preferred

- Established Business Credit wth an 80 Paydex Preferred.

How to leverage unsecured business credit that does NOT appear on your personal credit!

2. Pay per Performance

Strategic Negotiations to Instantly Get Approved

This company has ESTABLISHED relationships with banks that will get you faster and higher approvals.

No Personal Guarantee Corporate Funding up to $150,000

- Not based on Personal Credit – Not Required

- Credit Partner Accepted if you want more funding.

Business Credit Profile

- Corp or LLC that is 2+ years old.

- Corps or LLC under 2+ years NOT accepted.

- 20 Points Compliance Checklist a MUST!

- Established Business Credit with the following showing on your business credit report:

- Done with you: Cost $3000.00

- Business Credit Building Software: Access $2997.00 ( BEST OPTION )

Strategic Negotiations to Instantly Get Approved

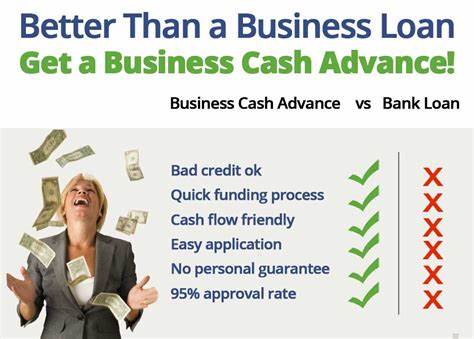

Business Working Capital up to $2 Million

We can fund your business fast within hours.

For those needing fast business funding, this may be a solution for you. We can fund up to $2 Million within 72 hours. We also offer a micro loan up to $25,000 in minutes.

Program Details:

This business cash advance is based on your business monthly revenues and not entirely on your personal credit.

Requirements:

- Been in business for atleast SIX months.

- A minimum monthly sales of $10,000 in the last THREE months.

- Personal Credit Score of at least 450

- Copy of DL

- Last THREE months Business Bank Statements, that will be verified.

- A short application

- A voided business check.

Business Lines of Credit and Term Loans up to $500,000

Program Details:

- Up to $500,000

- Simple one page application

- Terms: 24 to 72 months.

- Less than 24 Hours Approval

What we finance most industries. Here is a chance for businesses to have access to capital with a monthly payment. Great for those that have a merchant cash advance to try to get a monthly payment.

Business Credit Profile

- Corp or LLC that is 2+ years old.

- Must be atleast ONE year in business.

- 20 Points Compliance Checklist Preferred

- Established Business Credit wth an 80 Paydex Preferred.

No Minimum FICO

Equipment Financing – We can finance all equipment for your business.

Get the equipment you need to grow your business!

Program Details:

- Up to $5 Million

- Simple one page application

- Terms: 24 to 72 months.

- 24 Hours Approval

- Trucks

- Medical

- Industrial Equipment and Machinery

- Restaurant

- Construction

- Printing

- Farming

- IT Equipment

- All kinds of used and new equipment.

Business Credit Profile

- Corp or LLC that is 2+ years old.

- Start Ups Welcomed

- 20 Points Compliance Checklist Preferred

- Established Business Credit with an 80 Paydex Preferred.

SERVICES THAT CAN HELP YOU QUALIFY

FREE – Step by Step Instructions on how to Build Business Credit..

Simple Step by Step Instructions.

FREE – HOW TO BUILD BUSINESS CREDIT

The 20 Points Compliance Checklist.

Make your business credible.

THE 20 POINTS COMPLIANCE

When seeking funding or capital, the 20 points compliance that guarantees you that your company has been set up correctly is a must. This is a compliance check that banks and financial institutions will check before extending credit. Please make sure that you complete this checklist.

Vendor Accounts

These vendors accounts helps you establish and build business credit.

TIER 1 to TIER 8 – NET 30 VENDORS

Establishing a business credit profile and score is the only way to get maximum funding. There are many types of business funding out there, but to reach easy qualification, please establish about 8 to 10 accounts on your business credit which will give you an 80 Paydex score. You will qualify for Business Lines of Credit also without documentation.

You can continue to build by moving on to the next Tier of Vendors Accounts.

Aged Corporations or LLC

Discover the advantages of using an aged corporation or LLC.

Banks like to extend credit to businesses that are 2+ years old. Aged Corporations are a great tool that can be used to acquire maximum funding. Our partners offers aged corporations that are fairly priced. When using business credit for the sole purpose of raising capital to start a business or invest in real estate or whatever, this a great tool.

Professionally Register a New Corp or LLC

PROFESSIONALLY REGISTER A NEW CORP OR LLC

When registering a new corp or LLC, you want to be professional and hassle free. My Corporation offers professional business registration. Take the guess work out of the equation. Get it done professionally by the professionals.

They also offer expedited services and EIN application.

All completely done for you.

Done for you Business Credit Buildout

We have a done for you business credit buildout program.

Let the pros go to work. We will complete the 20 points compliance and establish 10 vendors accounts for you.

- The 20 Points Compliance

- We apply for 10 Tier 1 – Net 30 Accounts.

- Cost of Service: $5000,00

- For the 20 Points Compliance Only, we charge $2500.00

- Additional cost do apply!

NOVA TECH AFFILIATE PROGRAM

Crypto Marketing Services

FOREX AND CRYPTO TRADING PLATFORM

Introduce others to this amazing platform and earn!

Imagine Investing less than $1000.00 and you potentially make $10,000 per Month.

You can earn 3% per week or per day – There are risk involved like every other investments.

NovaTech’s mission is to empower individuals to achieve new financial heights and personal freedom by extending those same benefits to those around them. We aim to provide the highest level of quality and service possible with respect to the products and services that we offer and strive to create an environment and culture that lends itself to our Associates success. At NovaTech, Ltd we are committed to levelling the playing field, and providing customers around the world an equal opportunity to succeed.

Invest a little and bring others in and earn as an affiliate.

It’s a great platform. Learn more!

Disclaimer: There are risk involved in every investments. Please invest only what you can afford to lose!

REFERRAL PARTNERS WANTED

We offer TWO options to partner with us!

Become a referral partner today and start earning excellent commissions.

AFFILITATE PROGRAM – REFERRAL PARTNERS

FREE to join!

Become an affiliate today and get your own FREE affiliate website.

Why should you partner with Easy Access Capital LLC?

You can help small business owners and real estate investors, and earn a commission for each deal.

Easy Access Capital LLC Referral Partners help us identify small businesses with real opportunities for growth. It’s a great way to both earn money and strengthen your relationships.

Get started today-It’s easy! Just submit the contact form below and a Easy Access Capital LLC representative will contact you within 24 hours to provide all the tools you need to immediately begin increasing your income.

How the program works

Refer a business owner or anyone looking for capital, it’s that simple! After a loan is approved and funded, you receive a commission. For a step by step guide on how to become a successful loan agent, please fill out the form below.

You refer, we do the work!

BUSINESS IN A BOX – AUTO PILOT BUSINESS IN A BOX

Why Amazon Store or eCommerce Stores that cost $25,000+ to get started and capital for inventory. We offer an amazing business in a box for those that wants to earn on auto pilot.

All done for you Business Loan Broker Program.

Start earning $10,000+ per month on AUTO PILOT!

Everything done for you – Just watch the commissions come in.

You do nothing if you choose to – We automate everything for you.

− Fast and simple

Our process is straightforward and our decisions are quick.

− Compelling commissions

Earn money or pass along the savings to your customers.

− It’s easy

Sign up and start referring. It’s that easy.

This is the complete loan broker program. In this program you can assist all types of individuals looking for mosts types of capital. So you are not limited to a certain type of client. Everyone is a potential client.

Skip to main content

Skip to main content